20 Property For Sale in Australia

Don’t miss out! Keep up with the latest listings in Australia

Considerations of buying Australia property

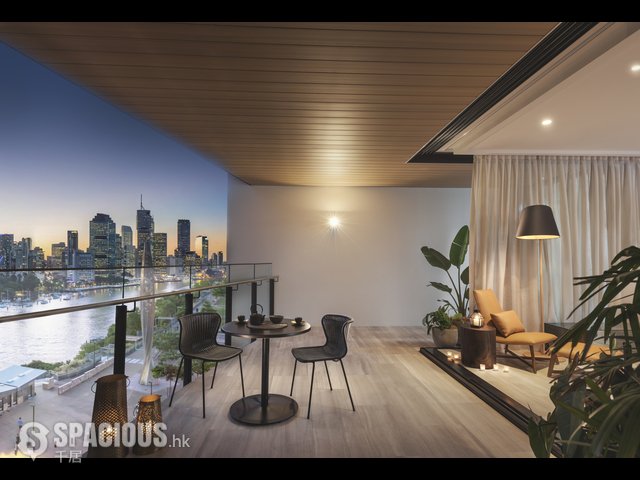

Investors are always faced with several choices when choosing to invest in Australia property. As Australian lifestyles and demographics change, buying an apartment ranks highly for investors looking to diversify their portfolio with a mixture of houses, townhouses and apartments. Let's review what investors must consider when buying an apartment (also referred to as “pre-construction” apartments).

Don't forget to run the following checks

- Due Diligence on Developer: Imperative to conduct the due diligence on the developer to ensure ethics;

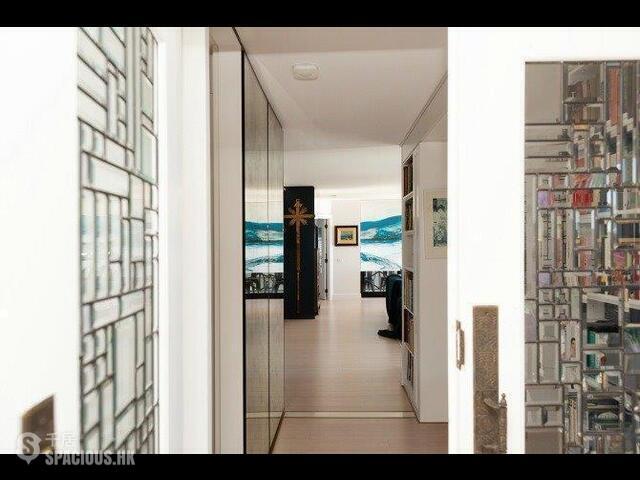

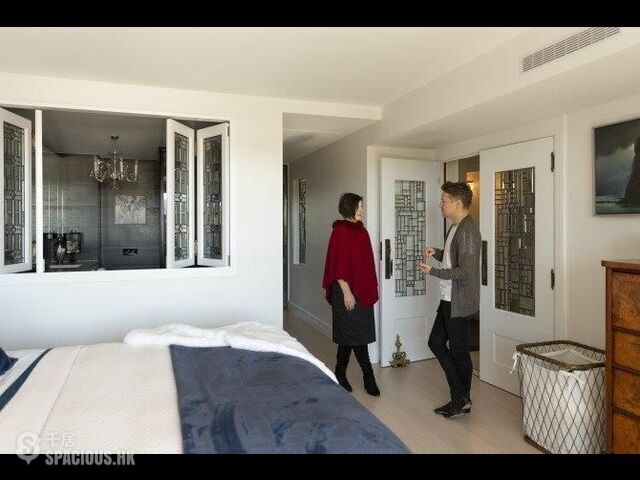

- Target Tenant Metrics: Location, design and quality of the development needs to satisfy what your target tenant is looking for;

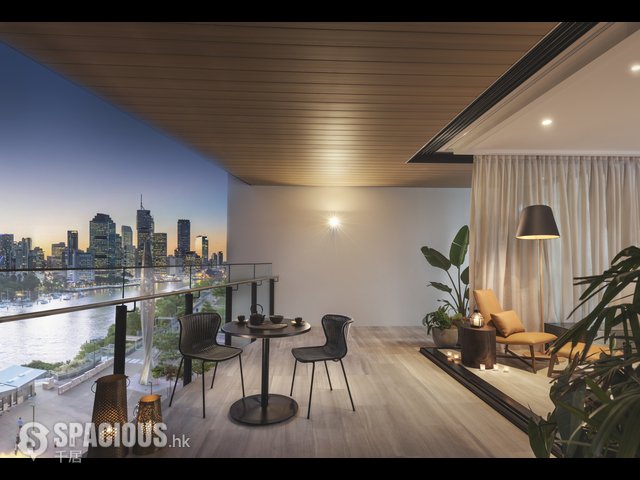

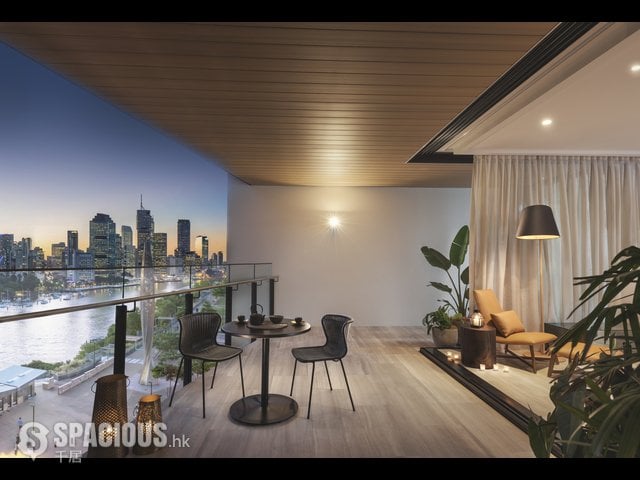

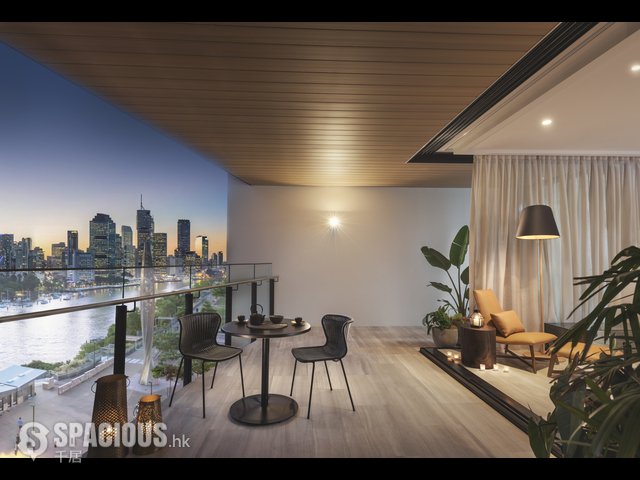

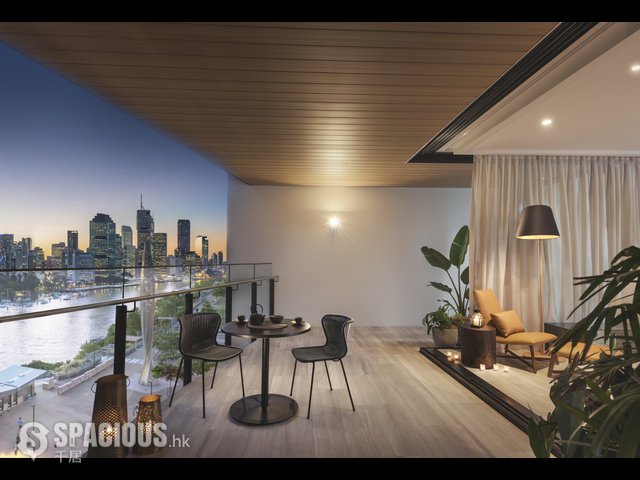

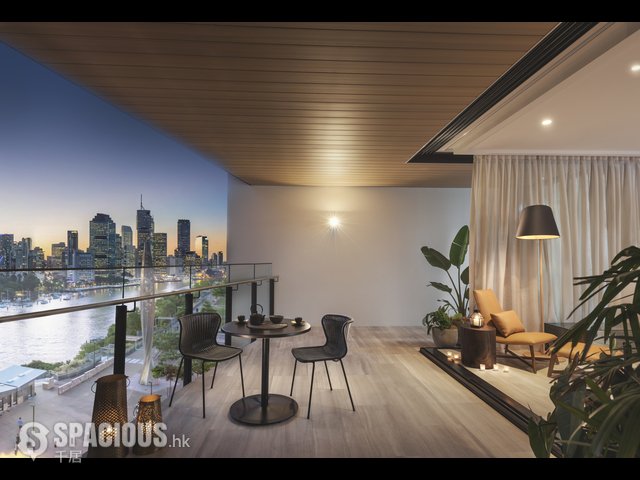

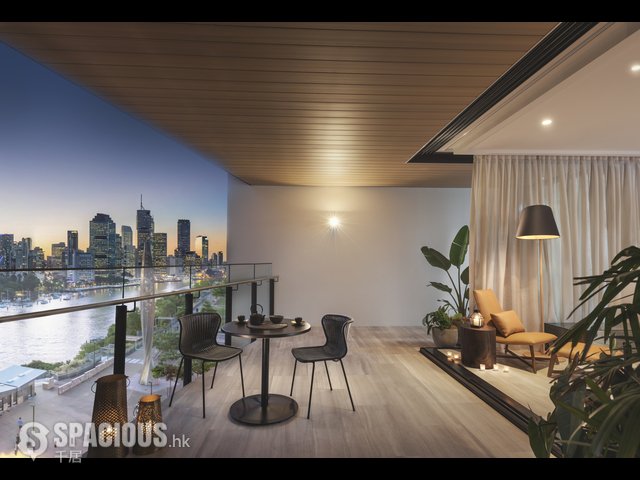

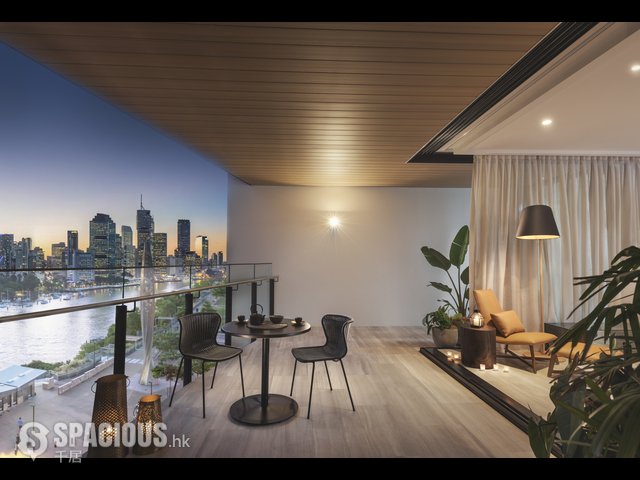

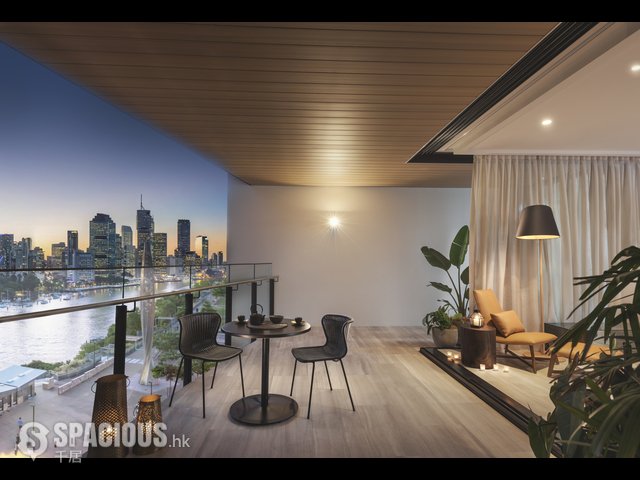

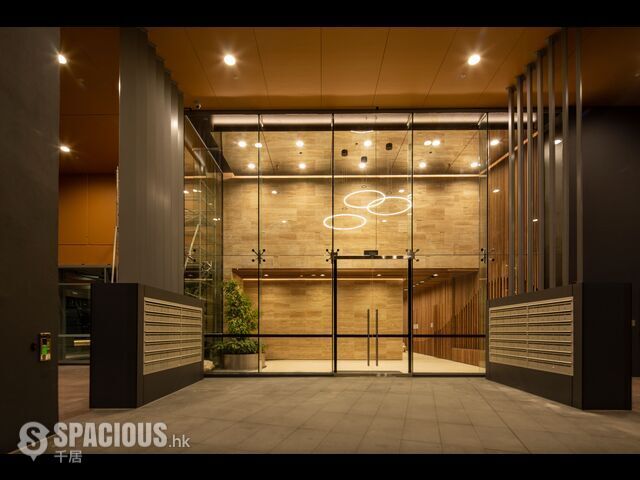

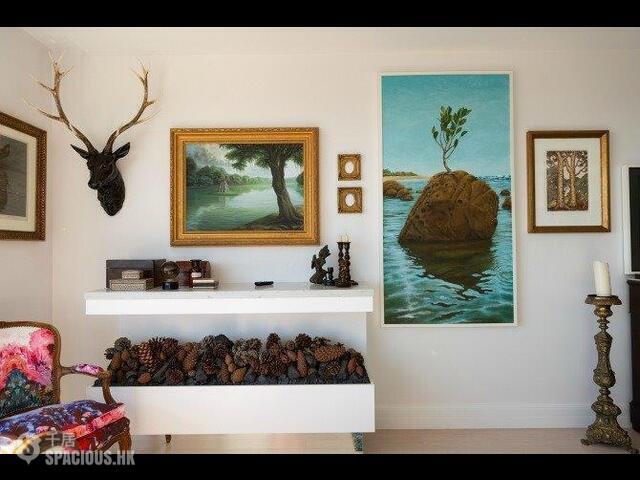

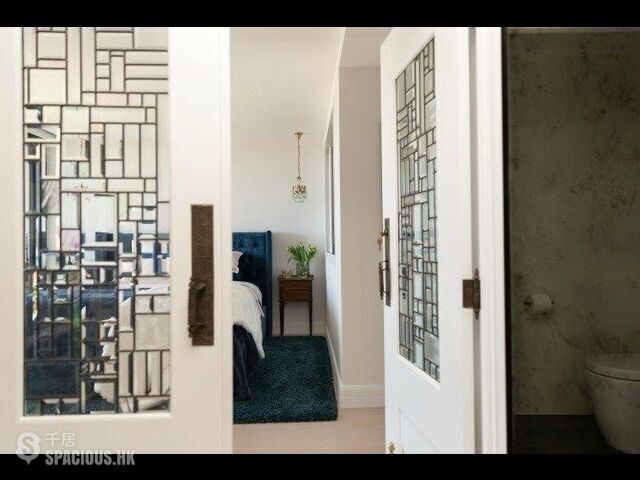

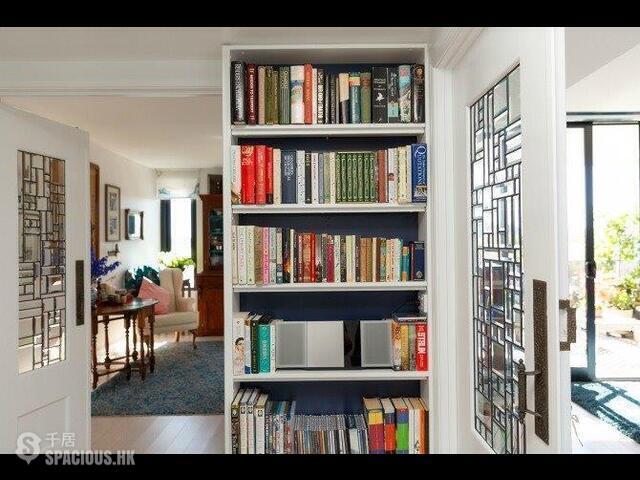

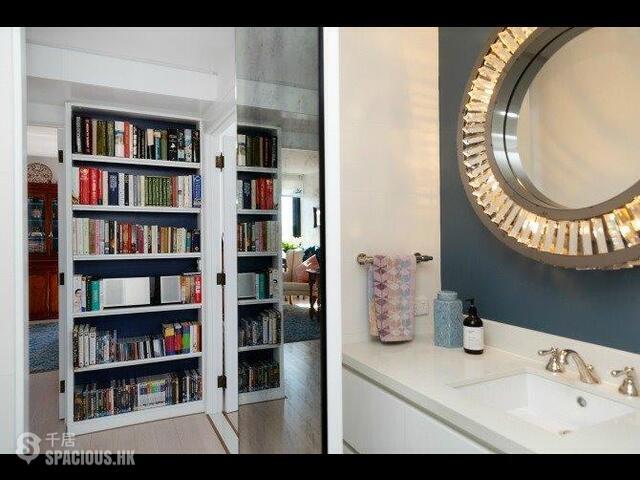

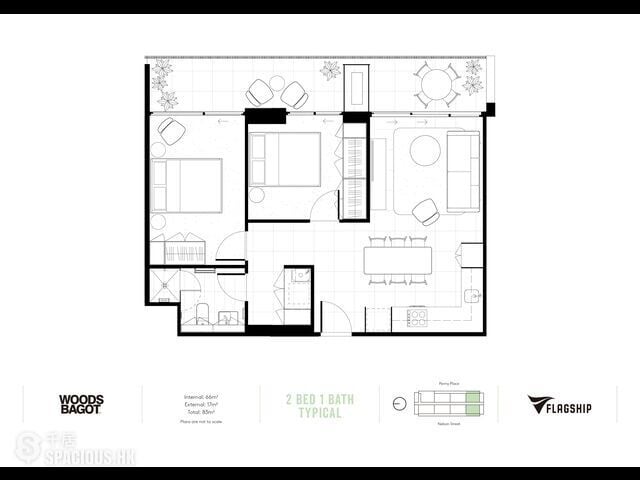

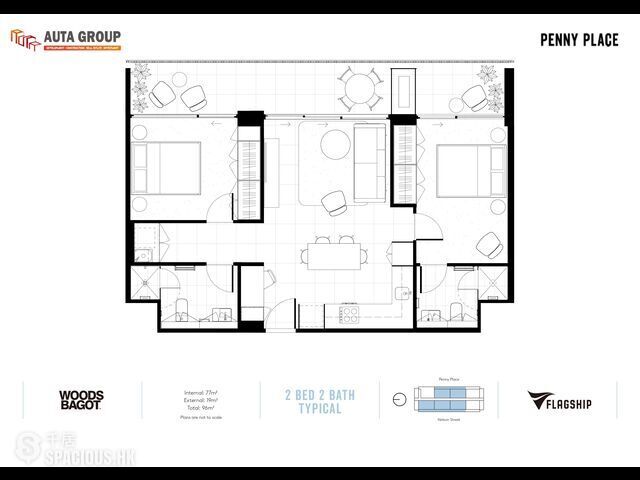

- Attracting premium rental return: Floor plan and inclusions in brand new apartments can attract premium tenants compared to older less modern style apartments.

- Check for oversupply: Research to ensure there is no potential for oversupply in the short term (too many apartments being built in one suburb).

- Timing: Buy at the rising stage of the property cycle, not in a hot or peak market

Benefits of purchasing Australia Property

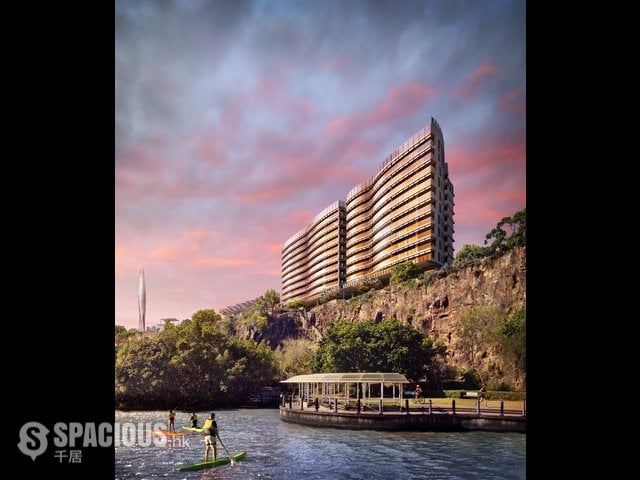

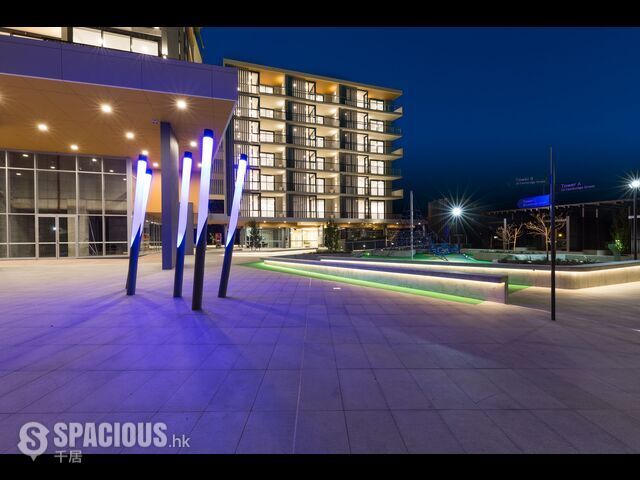

- Demographics & Demand: There are single person households, more downsizers, more young renters, more professionals, more empty nesters and people in general who are choosing an apartment lifestyle. Apartment living has become more popular over the last decade as lifestyle demands of being central to the city or major centres, of being closer to work, transport hubs, shopping, hospitals, universities and the café culture has created a new demand.

- Affordability: Investors can afford entry into major cities like Sydney and Melbourne as the median price of apartments has traditionally been less than the median price of houses. Investors get their foot in the door at a great market price, and to have the potential for capital growth by only buying in a rising market, with no holding costs during the 1-2 year construction phase.

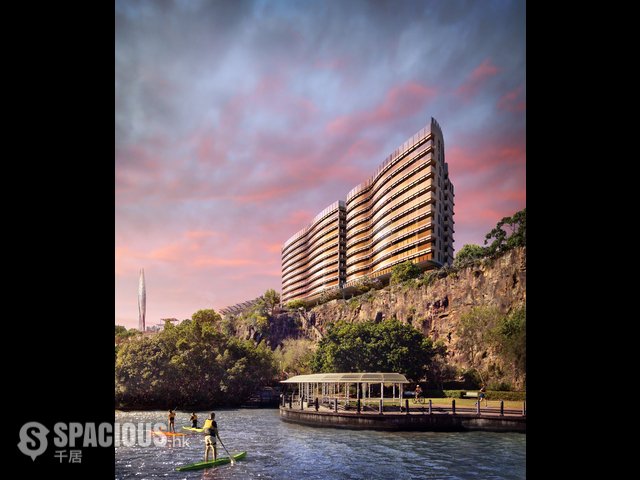

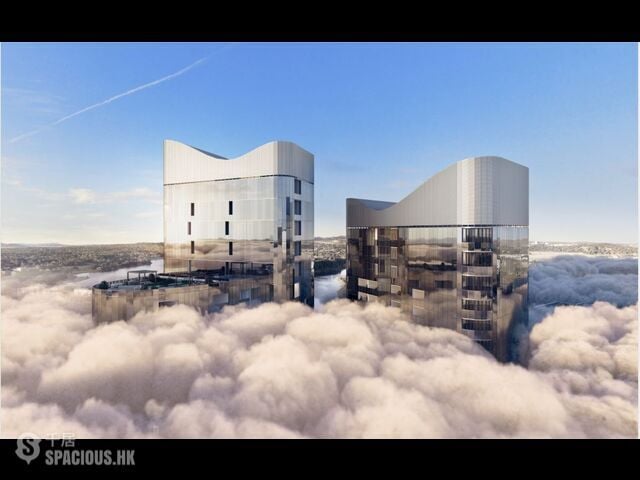

- Positive Cashflow, Capital Growth & Rental Yields: Apartments have shown the same trends as houses for capital growth especially in the major cities of Sydney, Melbourne and Brisbane. The population of these major capital cities is growing rapidly – Sydney has grown by over 1 million people in the last 5-years alone. More apartment developments are appearing on the skyline to meet the demand for this type of apartment living in the right urban or city location. Tenants are also willing to a premium for the extra facilities, views, location and designs that new apartments offer.

- Depreciation: The claimable losses from your property include the building and plant & equipment write-offs over 40 years. These depreciation claims on new apartments can give maximum tax benefits to the investor and make what appears to be a negatively geared property into a positive cash flow property after tax benefits. Strata fees, letting costs, and property management costs are also tax deductible.

Apartment living is now part of the Australia property landscape. Buyers can now view the best Australia properties on Spacious.