Since 2010, Wheelock Properties has been actively acquiring land in Kowloon East and its surrounding areas. In the Tseung Kwan O district alone, the developer has already acquired over ten plots of land, launching new residential projects including The Parkside (2015), Savannah (2017), Capri (2017), Monterey (2018), Malibu (2020), Montara (2021), Grand Montara (2021), Marini (2021), Ocean Marini (2022), and Grand Marini (2022).

The developer used to be a British company, but when did it become a Chinese-funded company? With its transition from a listed company to a private one, what opportunities lie ahead for Wheelock Properties? How is their building quality? Spacious analyzes the company’s development history and predicts its future direction.

Jump to: Development History | Wheelock’s Privatization and Prospects | Building Quality | FAQ

Development History

The Wheelock Company (“Wheelock”) was founded in 1857, and has a history of nearly two centuries. It has experienced prosperity and decline, and has transitioned from a listed company to a private one. Wheelock’s ups and downs are briefly in four stages:

1. Founded as a British company

In the 1840s, Opium War broke out in China and the Nanjing Treaty was signed between China and Britain. It stipulated that the Qing government had to open five coastal ports to British trade, and Shanghai was one of them.

Thomas Reed Wheelock, who came from Nova Scotia in Canada, saw the opportunity of Shanghai’s opening-up and brought his family’s shipbuilding and shipping experience to Shanghai. In 1857, he established a towing company called Shanghai Tug & Lighter Ltd.

However, the most influential person in the formation of Wheelock was not this Canadian businessman, but George Ernest Marden, who was born in Essex, a coastal town in England.

George Marden was originally a British soldier who was stationed in Hong Kong in 1912, and since then he has had an inexplicable connection with this tiny place.

In 1919, after World War I ended, he decided to stay in China and became the principal of the then China Customs Training School.

In 1925, he founded Marden & Co. in Shanghai, mainly engaged in shipping, warehousing, and customs clearance.

By 1930, Marden & Co. had become a successful listed company in Shanghai after operating for just five years . In 1932, the company merged with Shanghai Tug & Lighter Ltd and was chaired by George Marden. The new company was named Wheelock Marden & Co. Ltd., which was the prototype of today’s Wheelock company.

Wheelock Marden & Co. Ltd. actively expanded its business, covering areas such as steel, insurance, real estate and investment trust management. It became an English-funded company in the Shanghai of the time, with scale on par with major English brands, such as Jardine Matheson and Swire Group.

2. From Shipping to Real Estate

Wheelock Marden & Co. Ltd. was originally based in Shanghai in its early days, so how did it become an English-owned brand rooted in the hearts of Hong Kong people?

It turned out that the Pacific War broke out in 1941 and continued for nearly four years. This caused the local English-owned firms to flee Shanghai, and the company moved its business to Hong Kong for further development.

Having experienced many wars and turmoil, George Marden spent his whole life shuttling back and forth between China and England. After witnessing China’s rise and fall, he lacked confidence in Hong Kong’s prospects.

As a result, his business expansion plans changed, and he decided to return to his aspirations towards shipping businesses, offering more liquidity to reduce political risks. If war strikes again, the business can also be quickly moved to other places.

In 1959, at the age of 67, George Marden decided to retire and his 40-year-old son, John Louis Marden, succeeded him as the chairman of the board.

Marden changed the development strategy set by his father and was determined to strengthen investments in Hong Kong by developing the real estate and retail industry.

He subsequently expanded the real estate empire and acquired famous businesses such as the Realty Development Corporation Limited, owned by the prominent Chinese businessman Cheung yuk-leung’s family, the British department store Lane Crawford, the Chinese-funded department stores The Sun and Chung Hwa.

Find or sell properties on Spacious

3. From Real Estate to Shipping

Jardine Matheson’s real estate business flourished in the 1970s, but John Marden remained cautious about the future of Hong Kong and maintained a conservative development strategy, hoping to refocus the company’s efforts on shipping.

Meanwhile, other local Chinese-funded developers such as New World Development, Sun Hung Kai Properties, Cheung Kong Group, and Henderson had ambitious plans and took advantage of the lull in the property market during the 1967 riots, buying low and selling high, becoming the real estate tycoons of Hong Kong.

In contrast, while Jardine Matheson’s real estate business brought in considerable revenue, it did not perform as well as other developers.

John Marden’s obsession with shipping became apparent in 1979. By then, Hong Kong’s shipping industry was declining as a result of embargo orders and the Middle East oil crisis. Despite this, John Marden insisted on developing the shipping business.

When shipping tycoon Pao Yue-kong was pessimistic about the future of the industry and sold off his ships, Jardine Matheson did the opposite by using profits from real estate projects to expand its fleet of ships.

Unfortunately, the decline of Hong Kong’s shipping industry gradually became a reality in the 1980s. The Marden family misjudged the situation, causing the company to suffer losses. John Marden eventually abandoned the shipping business and left the market.

4. Becoming a Chinese-funded Company

February 1985 was a significant month for Wheelock. John Marden, who had devoted his entire life to the shipping industry, sold his 13.5% voting shares to former Singaporean richest man, Khoo Teck-puat, with plans to use HK$ 1.9 billion to fully acquire Wheelock.

It was reported that Wheelock’s major shareholder, Cheung Yuk-leung, had no knowledge of the acquisition. When the news broke on February 14th, Cheung felt betrayed by the Marden family and transferred his shares to Pao.

Pao had acquired The Wharf company five years ago, with a view to diversifying his business beyond the shipping industry. He was interested in Wheelock as he noticed that it could create synergy with The Wharf.

Khoo was the first to reveal his acquisition plan for Wheelock, giving Pao an upper hand over the acquisition battle.

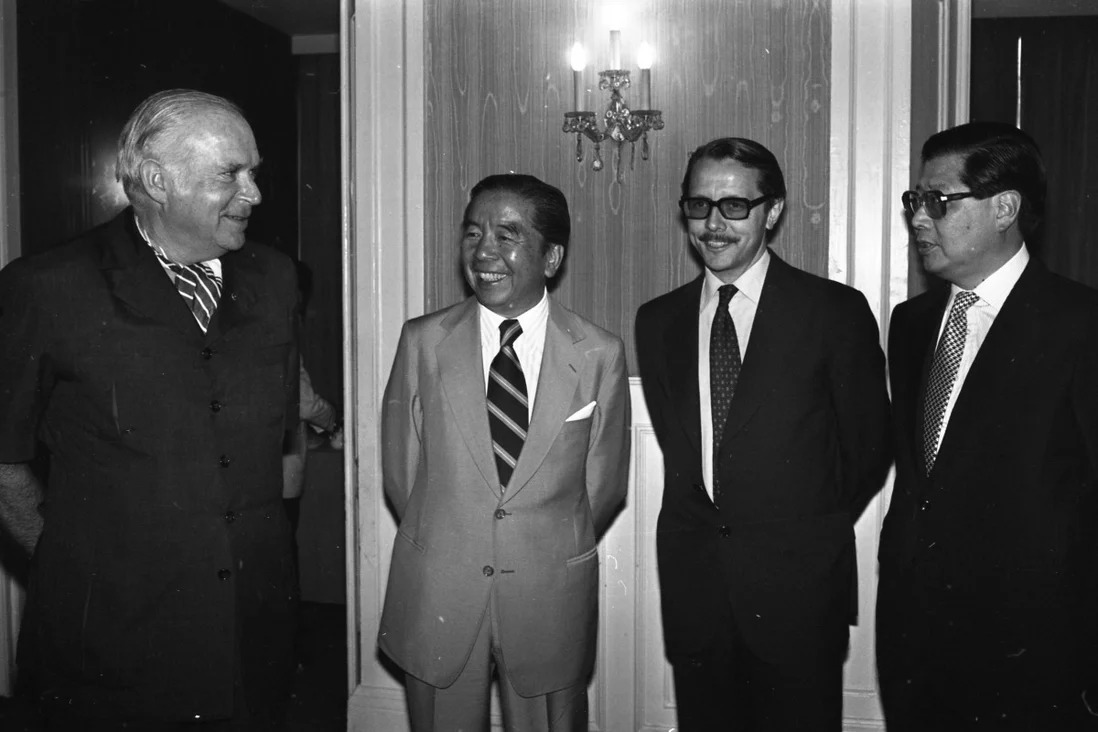

Within two days, Pao announced that The Wharf had acquired 34% of Cheung Yuk-leung’s family shares and offered to fully acquire Wheelock at a price higher than Khoo’s offer by 10%.

In the end, Khoo announced abandonment of the acquisition plan, and Pao came as the winner of the acquisition battle with a HK$ 2.5 billion acquisition price. Since then, Wheelock has transformed from a British-funded company to a Chinese-funded one.

After successfully acquiring Wheelock in the following year, Pao stepped down and the Wheelock was handed over to his second son-in-law Woo Kwong-ching.

In 2014, Woo resigned as chairman of Wheelock and was succeeded by his 35-year-old son Woo Chun-kuen, becoming the youngest chairman of a listed group in Hong Kong and still holding the position today.

Find or sell properties on Spacious

Wheelock’s Privatization and Prospects

2020 was another turning point for Wheelock. The company, listed on the Hong Kong Stock Exchange in 1963, was privatized in June 2020, using The Wharf stock plus cash in exchange for Wheelock shares.

The privatisation plan was later approved, and Wheelock was delisted on July 27 in the same year, marking the end of its more than half-century listing history.

Some people predict that Wheelock’s decision to go private is that the stock price was low and could not catch up with the net asset value of the group.

Moreover, Hong Kong’s retail market was hit hard between 2019 and 2020, posing a downward risk to the stock prices of Wheelock’s subsidiaries (“The Wharf (Holdings) Limited” and “Wharf Real Estate Investment Company Limited”).

Wheelock took the opportunity to announce the privatization strategy, using the two subsidiaries’ stocks, which had declined in price, to exchange Wheelock shares with small shareholders for financing purposes.

The main purpose of Wheelock’s privatisation is only understood by insiders. Undoubtedly, the group’s ambition in Hong Kong’s real estate sector has not diminished.

Since the appointment of Woo Chun-kuen as Chairman, the developer has become more proactive in acquiring land for residential and commercial properties.

Many of the Wheelock’s developments are in Kai Tak and Tseung Kwan O districts, making it one of the largest landlords in Kowloon East.

Building Quality

Wheelock Properties is one of the major landlords on the Peak, owning a portfolio of luxury properties for rent, such as Chelsea Court at 63 Peak Road, Mountain Court at 1 and 11 Plantation Road, 77/79 Peak Road, and 3-5 Mount Davis Road.

The developer has years of experience in constructing high-quality properties, and for some buyers, it is a benchmark of high quality. They believe that the property quality of its mass-market projects is superior to that of developers who are used to developing affordable housing.

Many of Wheelock’s new projects are outsourced to the renowned contractor, Gammon Construction, a leading Hong Kong contractor jointly owned by the British-owned Jardine Matheson Group and the UK’s largest contractor, Balfour Beatty. They are responsible for many private developer and government projects.

Find or sell properties on Spacious

FAQ

Who founded Wheelock?

George Ernest Marden (1892-1966), a British businessman, founded Wheelock’s predecessor, Wheelock Marden. In 1985, shipowner Pao Yue-kong successfully acquired Wheelock, and it became a Chinese-funded company since then.

What is the reason behind the privatization of Wheelock?

The group did not disclose the reason, but some speculate that the group took advantage of the two subsidiaries’ stocks, which had declined in price, to exchange Wheelock shares with small shareholders for financing purposes.